Mid-sized Chinese enterprises sharply less confident over revenue growth

China's mid-sized enterprises are sharply less confident about their revenue growth than their global peers, EY found in a survey today.

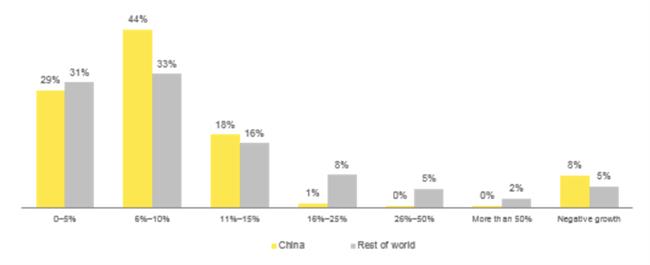

The EY Growth Barometer found that only 1 percent of Chinese respondents said they expected their revenue growth to exceed 16 percent next year, compared with 15 percent for the rest of the world.

It found 8 percent Chinese respondents expected revenue to decline, compared with 5 percent globally.

Overall, 63 percent of Chinese respondents expected a growth of over 5 percent in revenue, close to the global level of 64 percent.

The survey covers 2,340 companies from 30 countries and regions with annual revenue between US$10 million and US$3 billion as well as a number of rapidly-growing companies under five years old.

Chinese respondents chose changes in the structure of population and working patterns as the top disruptive factors to business models, while increasing competition, geo-political instability, and the cost of credit are also cited as top challenges to growth plans, the survey said.

The top priorities of Chinese respondents include geographic expansion, mergers and acquisitions, and launch of new products and services.

“We see Chinese middle market business leaders underpin their confidence with strategies to expand into new geographies and industries,” said Terence Ho, EY's Growth Markets Leader for China's mainland. “China's One Road One Belt initiative offers companies significant opportunities for regional and international expansion.”

The level of revenue growth companies plan for.