China launches yuan-denominated oil futures to help domestic producers hedge as it seeks a larger voice over pricing

China launched yuan-denominated oil futures contracts in Shanghai on Monday in a move to help domestic producers hedge crude price fluctuations and win itself a greater voice over oil pricing.

Trading started at 9am at Shanghai International Energy Exchange, also known as INE and a unit of the Shanghai Futures Exchange. By the 3pm close INE had conducted 42,300 transactions worth 18.3 billion yuan (US$2.9 billion).

The first trading day got off to a good start, with the most traded contract for September delivery rising 3.34 percent to 429.9 yuan by 3pm.

Investors can trade between 9am and 11:30am, and 1:30pm to 3pm, as well as from 9pm to 2:30am during working days, with each contract’s volume being 1,000 barrels.

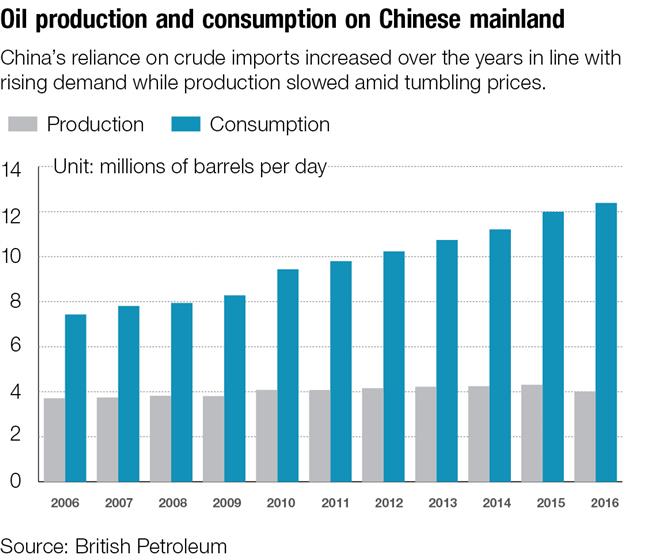

China imported 420 million tons of crude last year, taking up 69 percent of its total consumption, the National Bureau of Statistics said.

The rising imports have propelled China to surpass the US to become the world’s largest importer of crude last year, so the futures product’s launch is seen as a move to meet China’s increasing need to help its producers hedge against price fluctuations, said Jiang Mingde, chief counselor at domestic private equity Yixinweiye Fund.

While China’s oil producers have been trimming production in line with the tumbling crude prices in the past several years, “our reliance on imports has, however, increased as the demand continued to grow,” said Li Zhoulei, an analyst with Everbright Futures Co.

“We thus need a tool to help establish an oil pricing system reflecting supply and demand in China and even Asia,” he added. “It helps domestic producers better manage risks."

With London’s Brent and US West Texas Intermediate having long dominated the world’s crude pricing, it is hoped that the China's oil futures will help establish for the first time an Asia crude pricing system, Jiang said.

“That helps stabilize crude prices in this region against continuous struggles between US and Middle East countries which cause increasing uncertainties to China’s oil market,” he added.

In Asia, Singapore and Japan have been trading forward crude futures for years, yet a pricing system for this market hasn’t emerged so far, partly because demand in the two countries didn’t grow fast enough to boost trade.

The oil futures contract launched today is likely to help China “perform such a task, with our huge (crude) demand,” said Yin Qiang, deputy secretary general of China Petroleum Circulation Association which comes under the Ministry of Commerce.

A total of 156 domestic brokerages have registered at the Shanghai Securities Exchange to deal the oil future contracts by March 21, alongside 19 brokerages from abroad.

The oil futures contract is China’s first futures product allowing foreigners to trade, and is settled in yuan “echoing (China's) call for an increasing voice over global oil pricing and financial market,” Jiang said.

He said that such mechanism would create more stable prices for oil futures, which should be the first step to attract foreign traders.

But Li Yan, crude analyst at oilchem.net, a Shandong-based petrochemical consultancy, still thinks it is "too early to judge whether Shanghai crude will become a rival to Brent and WTI."

Jiang said that the key to that question lies in liquidity “which is now clouded with too many uncertainties.”

“Too many factors would sway the result, such as the changing global trading relations which would affect China’s futures regulations,” Jiang said.

The crude’s trading time is relatively short compared with other markets in the world, with WTI contracts able to be traded 23 hours per day, as “we have to open phase by phase, in case trading volume is too low at the beginning,” China petroleum circulation association’s Yin said.

Another main factor that influences liquidity is the development of the domestic crude industry.

Trading in the near term would be dominated by China’s state-owned giants which for long have rights to import crude, “but in fact the participation of more private oil refining companies will be a great bolster for higher liquidity following their rising capacity,” said Lin Boqiang, dean of China Institute for Energy Policy Studies at Xiamen University.

In Shandong, over 90 private oil refiners supply almost 70 percent of the nation’s oil refining capacity. They were once looked down on by global players as “teapots” due to their small scale and poor quality, but now “they deserve a larger attention to boost China’s crude industry,” Lin said.

The development of China’s crude oil futures would grow with the upgrading of the crude industry’s structure, “partly by giving more rights to the private companies.”

China has started that process because where previously fewer than 10 of the over 90 private oil refining companies in Shandong were given the right to import crude, “the number has risen to nearly 20 before the opening of crude futures trading,” oilchem.net’s Li said.

“Anyway, efforts should continue if we aim to win,” he said. “And that may take decades.”

Liu Shiyu, chairman of the China Securities Regulatory Commission, said increasing China’s importance over the global crude and financial markets would be a start as the first futures product allowing global participation marked a product innovation and opening up.