Setbacks mar online peer-to-peer lending

The decision of Internet financial services platform Juyouqian. com last month to cease peer-to-peer lending is a sign that industry self-regulation and government attempts to rein in the trouble-plagued sector are starting to show results.

“The Internet finance industry has been faced with severe fluctuations recently,” said a statement issued by Beijing-based Juyouqian. “The market environment is taking a turn for the worse, and investors show the lack of confidence, leading to the lower willingness to repay. Subjectively, there exists the behavior of maliciously escaping and abolishing debts, which has brought an significant negative impact.”

At present, platform users can withdraw available balances in their accounts, while assets that have not reached maturity will be frozen pending liquidation. That liquidation will be conducted in a prudent manner, the statement said, and efforts to collect payments from borrowers will be stepped up.

China peer-to-peer lending platforms came to the fore as a channel for lenders and borrowers to bypass traditional banks and bank regulations. Borrowers had easy access to money and lenders were promised handsome returns, which, at an average of more than 9.5 percent, can be double or even triple the deposit rates offered by traditional banks.

However, the industry has suffered a wave of closures amid a liquidity crunch and tightened government regulations. Amid outcry from people who have lost money on such platforms, the government has now banned all new players from entering the industry.

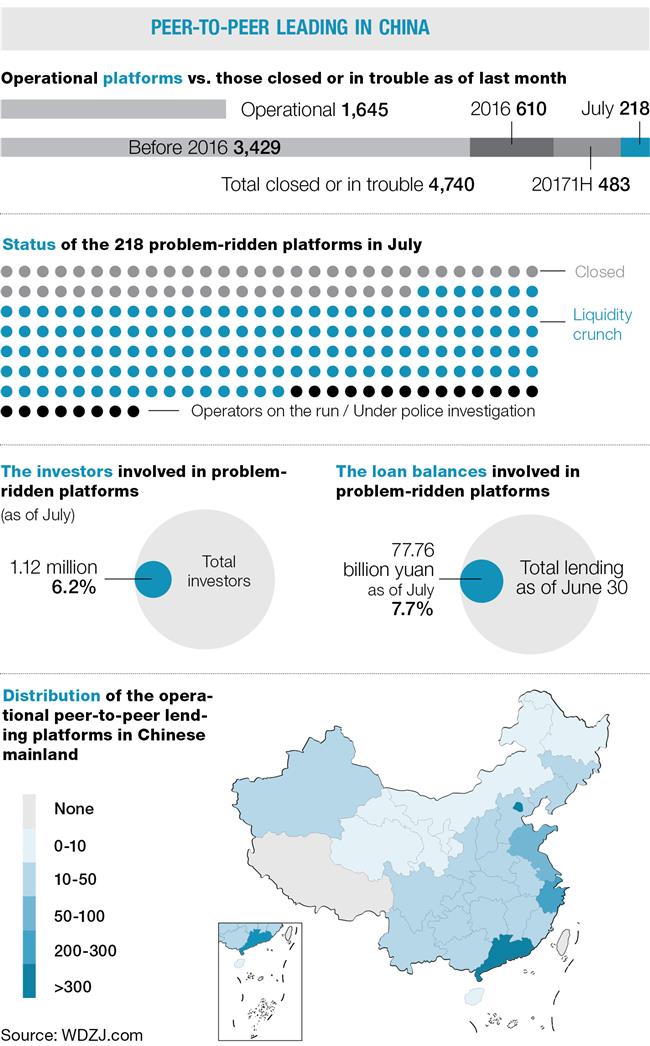

In May, 28 Internet loan platforms closed and the number jumped to 64 in June. The July figure was even higher, with the number of platforms closing, transforming or facing problems soaring to 218, according to data from WDZJ. com, an information platform for the online lending industry.

As of last month, the operational platforms in peer-to-peer lending fell to 1,645, after 4,740 platforms had either closed or were in serious trouble.

By the end of July, the number of investors involved in problem-ridden platforms had topped 1 million, accounting for about 6.2 percent of total investors, according to WDZJ.com. The loan balances involved totaled about 77.76 billion yuan (US$11.39 billion), accounting for about 7.7 percent of overall lending in the industry as of June 30.

Stricter regulation

Comments on related websites and social media show serious anxiety about the lenders and heavy concern among consumers that they might never get their money back.

The number of active lenders and borrowers in the online loan industry was 3.75 million in July, a 14 percent decline from a month earlier.

Despite all the problems, many investors are still drawn to the industry, especially after some of the platforms increased their rates of return as added incentive.

Xiao Sa, member of the China Banking Law Society, said the frequent emergence of problems associated with Internet financial platforms was partly due to new policies and stricter regulation. The poor capacity of some platforms to handle overdue loans and resolve bad debts is also a reason so many problems have arisen, she said.

The industry is all too aware of the problems that free-wheeling lending has caused. Local Internet finance associations across the country have voiced the need for reform. Member platforms of these associations are beginning to show stronger balance sheets.

Associations in Shanghai and the provinces of Zhejiang and Anhui jointly said on July 23 that they would undertake efforts to better manage loans and risk, counter negative public opinion and crack down on borrowers intentionally scamming the system.

They also pledged to establish a database of the “Yangtze River Delta untrustworthy” and blacklist industry workers who don’t follow the rules and lack integrity.

The Guangzhou Internet finance association on July 30 issued guidelines for the shutdown of loan platforms, stressing the need to inform financial authorities and associations and protect the rights of lenders.

It also said loan platforms should not relocate their operating offices, not close down their websites or mobile applications, and not allow shareholders and senior management personnel to stay out of touch.

Government regulators said that they will focus on self-regulation in the industry in the second half of this year, urging online lending institutions and associations to clean up their act.

Authorities will submit a list of issues that industry associations must address, including standards of inspection and year-end reports on their progress and achievements.

The People’s Bank of China announced on July 9 that overall risk in the Internet finance realm has “significantly dropped” due to the efforts at reform.