Digital payments render wallets obsolete

Sebastian Martin, an expat from the US, opened his first coffee shop on Haifang Road at the end of 2014, but the coffee shop didn’t really feel the take off of mobile payments until last year.

About half of the café’s 500,000 monthly transactions are now down without any cash changing hands.

"It helps me raise operational efficiency, and the digital bills provide an easier log of what sells best," he told Shanghai Daily.

Based on customer data, Martin said he is trying to raise his profit margin by adapting his menu to what new and returning customers seem to prefer.

He is among the tens of millions of merchants in China who are embracing the cashless era, using it to both attract new customers and retain fickle ones.

Alibaba-backed Alipay and Tencent’s WeChat Pay have launched a week long campaign of cash discounts, lucky draws and coupons to attract users to their digital payment services.

The come-ons don’t always work. One Beijing resident who declined to be identified said there are so many bewildering rules about obtaining and redeeming cash coupons that she doesn’t bother with them anymore.

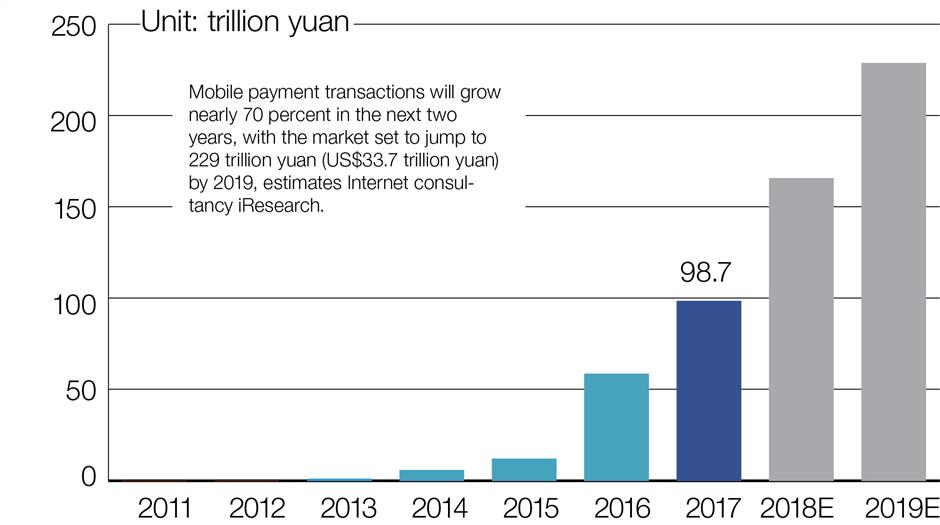

Mobile payment transactions will grow nearly 70 percent in the next two years, with the market set to jump to 229 trillion yuan (US$33.7 trillion yuan) by 2019, estimates Internet consultancy iResearch.

Sebastian talks to one customer in his cafe on Shaanxi Road S.

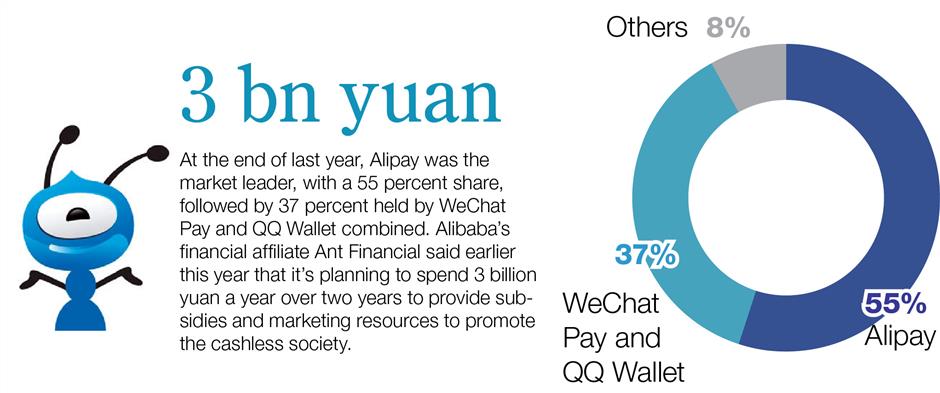

At the end of last year, Alipay was the market leader, with a 55 percent share, followed by 37 percent held by WeChat Pay and QQ Wallet combined.

Alibaba’s financial affiliate Ant Financial said earlier this year that it's planning to spend 3 billion yuan a year over two years to provide subsidies and marketing resources to promote the cashless society.

An Ipsos survey of 6,600 consumers last month found that 84 percent of respondents have no worries about leaving home with no cash, while 12 percent said lack of notes in their wallets makes them feel uncomfortable. The remaining 4 percent said they would actually return home to get some cash if they had forgotten it.

According to the People’s Bank of China’s payment and settlement department, the country handled 125.1 billion non-cash payments last year, up a third from 2015. The number of mobile payments surged 86 percent to 25.7 billion, totaling 157 trillion yuan.

Outbound Chinese travelers are the latest target of payment service providers. Baidu platform Baidu Wallet last month said it teamed up with PayPal to allow consumer payments through Wallet to be accepted by 17 million PayPal merchants globally.

The deal comes as Ant Financial and Tencent are also making aggressive moves to expand their payment networks overseas.

Baidu Wallet has around 100 million monthly users, lagging Alipay's more than 400 million and WeChat Pay's more than 600 million. WeChat Pay is now accepted in 19 offshore locations.

In one example, Japanese discount chain Don Quijote Co has been working with WeChat Pay to provide Chinese tourists in Japan not only payment services but also access the store’s online marketplace. That means they can purchase goods even after returning to China.

“For overseas merchants like us, WeChat is so pervasive in China that it provides a relationship network that we can leverage,” said Chen Chao, who oversees Don Quijote’s online overseas strategy.

Mintel research analyst Aaron Guo said the domestic mobile payment market is already so locked in that there is little room for players beyond Alipay and WeChat Pay. Providers will need to push harder in areas outside first-tier cities if they want to expand.

Xu Yanghui, head of operations at WeChat Pay’s catering and transportation services division, said most third-party digital service providers who help merchants connect with WeChat Pay are gradually shifting focus to lower-tier cities.

Cheng Jiaqi, a regional manager at Mwee, which provides IT services such as payment, digital menus and digital queuing systems for the catering industry, said most eateries can’t afford high commissions.

“Small and medium-sized restaurants don’t have the budgets to offer coupons,” he said. “For them, a lower commission rate means a lot.”

Mintel’s Guo said more incentives need to be aimed at merchants. “If discounts are offered only to consumers, they soon grow tired of the promotions,” he said. “Merchants also need to be educated about the advantages of accepting digital payment.”

So, where does the cashless society leave elderly residents used to paying with notes and coins, and those who aren’t plugged into the nuances of the cyber world?

Fu Weigang, vice president at the Shanghai Institute of Finance and Law, said the new trend is a double-edged sword. Getting rid of counterfeit bank notes and saving on transactional costs are the most obvious advantages of cashless payments, he noted, but that can leave some people marginalized.

Skepticism about digital payments also revolves around fears that personal information may be compromised by disreputable merchants or third-party service providers.