Investment down in 2020 but medical and technology still booming

China's financing volume dropped almost 10 percent in 2020 due to the pandemic, but sectors such as semiconductors, medical, education and smart driving experienced solid growth, according to Shanghai-based Tigerobo, an artificial intelligence startup.

Shanghai is among the top three investment regions nationwide, with leading positions in AI and grocery consumption, according to Tigerobo, which sorts and analyzes data using AI.

In 2020, there were 3,124 financing cases in the Chinese primary market totaling 757.7 billion yuan (US$116.6 billion), a 9.9 percent decrease from 2019.

Enterprise services, medical & health-care and semiconductors were the fastest-growing industries that attracted investment in the country. Semiconductor industry attracted more investment last year than that of 2019 with companies like SMIC, the Chinese mainland’s biggest chipmaker, leading the way.

Personalized and offline education services, including one-on-one teaching, will continue to grow in China, with parents willing to pay for their children’s studies and self-improvement, giving educational organizations high potential for investment value, according to UBS analysts.

OneSmart, which offers customized services for students, estimates a million high-end Chinese families have considerable spending abilities.

Education demand continues to boom in China.

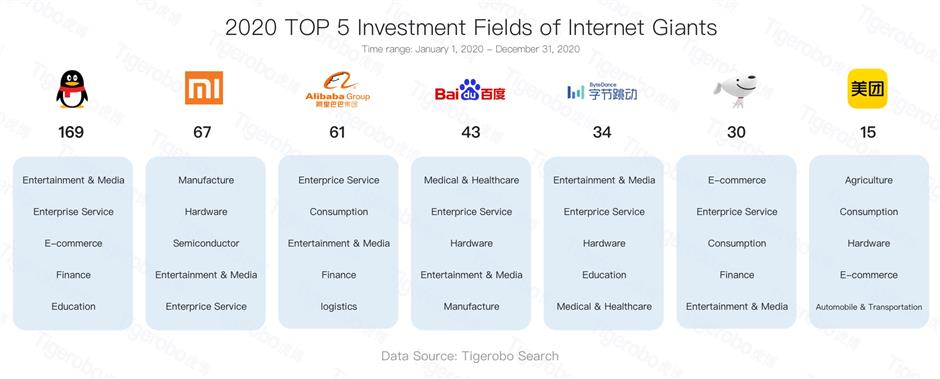

Among all fiancing, Beijing ranks No. 1 with 794 cases, followed by Shanghai with 616 and Guangdong Province with 583. Tech giants like Tencent, Xiaomi and Alibaba actively invested in 2020, according to Tigerobo.

IT giants didn't stop investing in 2020.

Shanghai was at the top of the grocery consumption sector, accounting for 24 percent of financing cases nationwide in 2020. Local firms like Dada, Dingdong Maicai and Aikucun reported increased investment in 2020, due to the city’s strategy to boost online consumption and the digital economy.

AI has become the calling card of Shanghai with big investments in personnel, as well as hosting the World Artificial Intelligence Conference. Top AI startups including SenseTime, CloudWalk and Yitu have set up facilities in Shanghai. Shanghai-based Yitu announced earlier this week its plan to list on the Shanghai STAR Market.