New Beijing stock exchange a beacon of hope for smaller companies

China's first new full-fledged stock exchange in three decades is aimed at providing a funding channel for small and medium-sized businesses, many of which were hurt by the coronavirus pandemic, rising costs and supply chain disruptions.

The Beijing stock market, expected to begin trading by the end of the year, is part of an overhaul of the city's over-the-counter National Equities Exchange and Quotations (NEEQ), which was set up in 2013. Some 66 select companies among the thousands listed on that exchange are expected to be the first on the new stock market.

Xu Ming, a former academic who rose to prominence as a market reformer, was appointed chairman of the new exchange.

The Beijing bourse is the first to be created since 1990, when the Shanghai and Shenzhen exchanges were born, though there have been multiple new sub-boards created to expand the nation's capital markets.

Its importance was underscored by the fact that it was first announced by President Xi Jinping last week.

He said it will be a "primary platform" for small and medium-sized businesses involved in innovative endeavors.

Small and medium-sized companies, which are mostly privately held and account for the majority of jobs in China, are considered a backbone of the economy but have often suffered roadblocks in securing funding for development and expansion.

Xi's announcement caught many market players by surprise. The impact of the new market on existing stock markets, on initial public offerings and on investor sentiment is yet to be determined.

The Hong Kong stock exchange and shares on Shenzhen's ChiNext board fell after the announcement, perhaps a sign that investors fear the new exchange will siphon business from them. ChiNext caters to small and medium-sized companies.

However, shares in many brokerage firms rose in anticipation of more trading business.

Dong Dengxin, director of the Financial Securities Institute of Wuhan University of Science and Technology, said the new Beijing stock exchange mirrors a trend of the times as China tries to enhance innovation in the business sector and put more consumer savings to work for economic growth.

"In terms of positioning, the Beijing stock exchange will cater to small and medium-sized high-tech enterprises," he said. "It will also make up for the lack of stock exchanges in the north of China."

Analysts hailed the creation of the new market.

Shao Yu, chief economist at Orient Securities, said it's a leap from quantitative to qualitative in reforming the national over-the-counter market and a big step forward in China's development of a multi-level capital market, following the launch of Shanghai's Nasdaq-style STAR board more than a year ago.

Zong Peimin, chairman of venture capital firm Sinowisdom, said the new exchange is like adding a gas station to improve traffic flow.

He predicted the Beijing exchange will handle between 200 and 300 initial public offerings per year, with the nation's three major bourses adding 600 to 800 companies. That should alleviate the long-standing problem of congestion in funding channels for Chinese companies seeking to go public.

The 66 over-the-counter stocks likely to be the first listed on the new market have an aggregate market value of 185.8 billion yuan (US$28.8 billion) and profits of 3 billion yuan.

The China Securities Regulatory Commission, the country's securities regulator, said the "registration-based IPO system," adapted from the West and piloted in Shanghai two years ago, will be implemented on the new market. The system is aimed at improving market transparency and reducing the lengthy regulatory review for new listings.

The new market will also be open to qualified foreign investors under an existing system of access.

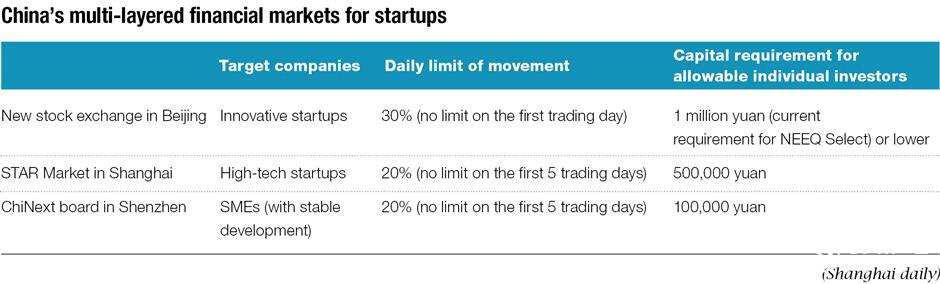

The daily price movement on the new stock exchange will be limited to 30 percent, but there will be no cap on first-day trading, said an official from China's securities regulator. That will give the market leeway in efficiently pricing new shares.

The commission said it expects shares on the new exchange will have a lower trading frequency than other exchanges, with a focus on longer-term returns.

"Faced with multiple challenges, including the coronavirus pandemic, rising commodities prices, and supply chain disruptions, small and medium-sized businesses are now in a relatively more difficult situation, and supporting them is an important task for achieving global economic recovery and growth," Yi Huiman, chairman of the regulatory commission, said this week.

In the past three decades, debate has waged about whether China should create a third major exchange. Dong said now that the decision has been made, he expects the Beijing bourse will show rapid expansion in the number of listed companies.

An individual investor surnamed Zhou, who has invested in companies listed on the National Equities Exchange and Quotations since 2017, said he is excited because the "the news has activated this market, which had been languishing from low liquidity for years. I believe it will attract lots more investors and capital into the over-the-counter system."

Indeed, a day after news of the new exchange broke, three companies on the national over-the-counter market – Shanghai I2finance Technology Co, Transcom Instruments Co, and Honsun (Nantong) Co – said investors were increasing their shareholdings.

Shares of some 60 select companies on the over-the-counter market surged at least 10 percent as investors banked on their inclusion in the new exchange. Trading on the over-the-counter market has been fairly languid in the past.

The National Equities Exchange and Quotations market is the sole shareholder of the new Beijing stock exchange, which registered with capital of 1 billion yuan.

Xu, newly named chairman of the Beijing exchange, holds a master's degree from East China University of Political Science and Law in Shanghai and a law doctorate from Renmin University of China Law School in Beijing.

He worked at the securities regulatory commission more than a decade before becoming deputy general manager of the Shanghai Stock Exchange – a job he left in 2016 to work as general manager at an arm of the regulatory commission.

Xu joined the National Equities Exchange and Quotation in 2018 and became its chairman earlier this year. He is credited with making reforms at the over-the-counter market to improve its liquidity, including lowering the capital requirement for participating individual investors to as low as 1 million yuan.

He also implemented a three-tier system to allow companies at various stages of development to list.